Sector

The Fund has a general industry focus. Within the target region, several high growth sectors are identified where TBL has built a strong pipeline and track record, including ICT, Healthcare, and Consumer Goods. The goal is to build top market players that are attractive acquisition candidates and add value through the Fund’s investor network. The Fund therefore targets businesses in high growth sectors where competition is relatively limited, exit opportunities are good and businesses have failed to flourish for reasons of under-capitalisation and limited institutional support.

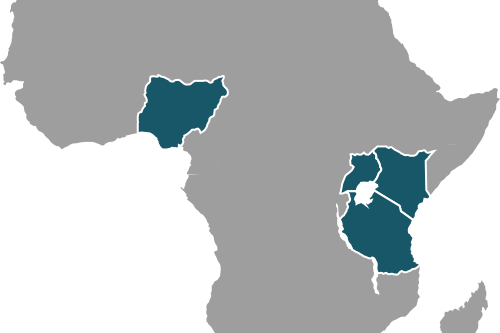

Geographical

Land area, thousands of km² - 923

Population, million (2011 est) - 162.5

GDP per capita, PPP USD (2011) - 2,533

Currency, EUR 1 = NGN 206

Most of TBL Mirror Fund’s portfolio companies have seen increased business being generated from Nigeria, and several have opened offices there (Cellulant, TKM Maestro and Research Solutions). Nigeria is a large market in terms of population and is also a market that needs strong local knowledge. To provide local support in Nigeria to its companies, TBL entered into a partnership with Sahel Capital’s Mezuo Nwuneli end 2011. He has been and will be providing support to the fund’s portfolio in Nigeria. Over time, and through the various interactions with Sahel, TBL has identified a huge opportunity for SME investing in the range of up to EUR3.5 million, and has started to develop an interesting deal flow pipeline. Nigeria has attractive economic indicators with a 7-8% annual GDP growth rate; fast growing ICT, agribusiness and financial services sectors; and a large, well-educated workforce.

Population, million (2011 est) - 162.5

GDP per capita, PPP USD (2011) - 2,533

Currency, EUR 1 = NGN 206

Most of TBL Mirror Fund’s portfolio companies have seen increased business being generated from Nigeria, and several have opened offices there (Cellulant, TKM Maestro and Research Solutions). Nigeria is a large market in terms of population and is also a market that needs strong local knowledge. To provide local support in Nigeria to its companies, TBL entered into a partnership with Sahel Capital’s Mezuo Nwuneli end 2011. He has been and will be providing support to the fund’s portfolio in Nigeria. Over time, and through the various interactions with Sahel, TBL has identified a huge opportunity for SME investing in the range of up to EUR3.5 million, and has started to develop an interesting deal flow pipeline. Nigeria has attractive economic indicators with a 7-8% annual GDP growth rate; fast growing ICT, agribusiness and financial services sectors; and a large, well-educated workforce.

Land area, thousands of km² - 241

Population, million (2011 est) - 34.5

GDP per capita, PPP USD (2011) - 1,354

GDP growth (2011) - 3.5%

Currency, EUR 1 = UGX 3,493

As with most other countries in sub-Saharan Africa, the Ugandan economy is s?ll dependent on agriculture. The discovery of oil, however, will likely shiP the country’s aJen?on away from agriculture and towards oil, as has happened elsewhere. Economic growth in 2010 was driven primarily by the telecommunica?ons, financial services and construc?on sectors.

Population, million (2011 est) - 34.5

GDP per capita, PPP USD (2011) - 1,354

GDP growth (2011) - 3.5%

Currency, EUR 1 = UGX 3,493

As with most other countries in sub-Saharan Africa, the Ugandan economy is s?ll dependent on agriculture. The discovery of oil, however, will likely shiP the country’s aJen?on away from agriculture and towards oil, as has happened elsewhere. Economic growth in 2010 was driven primarily by the telecommunica?ons, financial services and construc?on sectors.

Land area, thousands of km² - 580

Population, million (2011 est) - 41.6

GDP per capita, PPP USD (2011) - 1,710

GDP growth (2011) - 4.3%

Currency, EUR 1 = KES 113

Kenya has become a more and more attractive area for investment because of its growing middle class, business friendly political environment, well developed advisory services from legal, financial to IT, a growing network of banks focused on SMEs and a relatively active stock exchange. It is the most diversified, mature economy in the region and serves as a finance and transport hub. TBL has seen Kenya gradually evolve into the hub for doing business in East Africa. This has been driven by a number of mutually supportive factors:

Population, million (2011 est) - 41.6

GDP per capita, PPP USD (2011) - 1,710

GDP growth (2011) - 4.3%

Currency, EUR 1 = KES 113

Kenya has become a more and more attractive area for investment because of its growing middle class, business friendly political environment, well developed advisory services from legal, financial to IT, a growing network of banks focused on SMEs and a relatively active stock exchange. It is the most diversified, mature economy in the region and serves as a finance and transport hub. TBL has seen Kenya gradually evolve into the hub for doing business in East Africa. This has been driven by a number of mutually supportive factors:

- Development of the PE market

- Several multinationals moving their Africa HQ to Kenya

- Relatively well developed stock market

- Increased M&A activity

- Regional intergration in the East African Community

- Increased interest from India and China

Land area, thousands of km² - 945

Population, million (2011 est) - 46.2

GDP per capita, PPP USD (2011) - 1,512

GDP growth (2011) - 6.5%

Currency, EUR 1 = TZS 2,081

Tanzania’s economic growth has been strong and rela?vely stable over the past decade, underpinned by the construc?on, mining and service sectors. The Tanzanian economy is expected to con?nue to expand at the rate of approximately 6.5% to 7% in the next few years, which is consistent with its performance over the past decade. Investments in mining, especially gold, and the emergence of private ac?vi?es boosted by beJer infrastructure, regional growth, and policy reforms in the business environment.

Population, million (2011 est) - 46.2

GDP per capita, PPP USD (2011) - 1,512

GDP growth (2011) - 6.5%

Currency, EUR 1 = TZS 2,081

Tanzania’s economic growth has been strong and rela?vely stable over the past decade, underpinned by the construc?on, mining and service sectors. The Tanzanian economy is expected to con?nue to expand at the rate of approximately 6.5% to 7% in the next few years, which is consistent with its performance over the past decade. Investments in mining, especially gold, and the emergence of private ac?vi?es boosted by beJer infrastructure, regional growth, and policy reforms in the business environment.